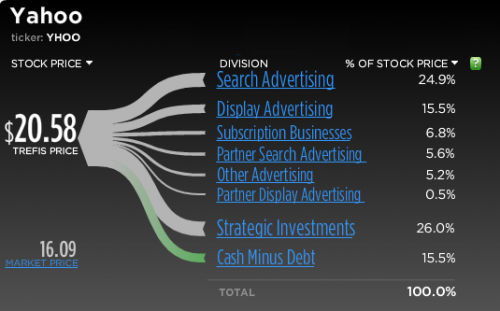

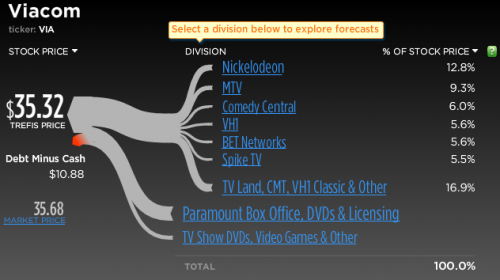

I recently discovered Trefis and their Sankey-style diagrams as a visualization. Trefis models are used to determine the target stock price for companies, by looking at their product portfolios and playing around with the expected growth rates and market shares. Well, there is a whole model behind these interactive graphics, but the interesting part is that the share of the companies turnover is broken down by products, and is shown with proportional Sankey-like arrow magnitudes.

At the tip of the joint arrow head you can see the target share price, which is calculated as “the result of mathematically combining all of our forecasts for a company into a single number representing the per share value of the company.” When playing around with the parameters, this value will adapt accordingly.

Here are some examples:

Forbes, techCrunch and the New York Times all reported about what the latter calls “America’s Next Top Stock Model”, but none of the mentioned Sankey diagrams though.

Have fun playing around with the models … they have fancy Web2.0-silverlightish animations too. But don’t blame me if the share doesn’t reach the forecasted price 😉